OTHER INDUSTRIES SERVICES

Other Industries We Offer Our Payroll Processing Services to in the Long Island, NY Area

Payroll Processing is crucial in a business, primarily operating in the Long Island, NY area. It can either be a source of profit or a significant source of loss. We know that managing payroll can be a very challenging and daunting process, and that’s where we come in. We don’t just offer our payroll services to restaurants; we also provide payroll and HR services to any industry that needs help with them. We save clients time and money so that they can focus on running their business.

Whether you’re a professional practice, auto body shop, not-for-profit, or restaurant, we strive to make all clients feel like they matter to us regardless of the size of their organization. We’ve been helping clients in the Long Island area with their payroll processing needs for over a decade. The difference between us and other payroll processing companies is that we add a personal touch. If a client has a question about their payroll processing, we answer almost immediately and are always there for them when they need us. Other payroll processing companies are significant, and you won’t get that hands-on approach like you would with Premier Payroll.

Contact Us

Contact us today if you would like to use our payroll services. We are located in the Long Island, NY area and would love to help find a solution for you.

PAYROLL ADMINISTRATION

Payroll taxes can be complicated, confusing, and compliance is constantly changing. PPS handles all the calculations of Federal, State, and local agencies. We make all the necessary payments on behalf of our clients. Should there be a mistake in a payment we pay the penalty and interest. It is like having insurance for your payroll tax obligations.

ELECTRONIC ONBOARDING

Hiring new candidates can be inefficient and tedious. New hire paperwork can become overwhelming, and keeping track of a stack of documents is not ideal. Our paperless onboarding module notifies personnel in a timely manner and

takes them through all of the necessary tasks, forms and steps. Electronic Onboarding will streamline and allow any New Hire to enter information directly into our software avoiding multiple data entry.

GENERAL LEDGER INTEGRATION

Premier offers all of its client the ability to create a GL file that can be uploaded directly into their accounting software such as Quickbooks or Restaurant 365.

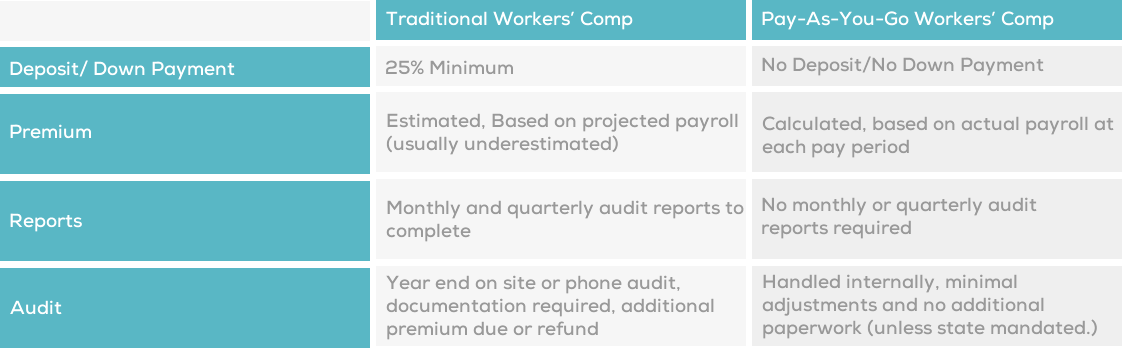

PAY AS YOU GO WORKERS’ COMPENSATION

PAYGO (pay-as-you-go )billing solution for your worker’s compensation coverage. This allows you to pay your workers compensation premiums as you run your payroll each pay period. This solution makes it easier than ever to manage cash flow. Premiums are automatically drawn from your designated checking account every time payroll is processed.

- Save time and money

- No down payment or deposit Premium is calculated on actual payroll at each pay period, not estimated

- Competitive rates with quotes from multiple insurance companies

- No checks to write, premium is automatically debited

- No monthly or quarterly audit reports to complete

- Audit adjustments are minimal–audit process handled internally with no additional paperwork, unless state mandated PPS doesn’t sell insurance.

We work with your current to link it to your payroll.

AFFORDABLE CARE ACT

ACA compliance can seem complex and confusing, but you don’t have to go it alone. Rely on PPS’s experts to help you understand what your organization needs to do to comply with the ACA’s employer requirements. Our specialists can help you navigate this kind of complexities and stay on top of regulatory changes.

In addition to the complex requirements, you need to analyze and access data from various systems — including benefits, payroll, and HR.

Get organized with:

Consolidated compliance reporting that helps determine employee classifications

Marketplace/Exchange notice management

Simplify Year End reporting but streamlining the process for all 1094-C and 1095-C printing and filings

MINIMUM WAGE

At the end of each calendar year, you need to make sure and verify what the new minimum wage will be in your area. In states like New York, minimum wage varies depending on where you work and whether or not you earn tips.

TIME & ATTENDANCE

Our Time & Attendance solutions will help improve the productivity, accuracy, and reliability of your payroll process. You as the customer have the ability to choose which method of collecting the data works best for you. Whether it is web-based, swiping employee cards, or biometric finger recognition we have the right solutions for your business.

SPREAD OF HOURS

Spread-of-Hours pay is due when the length of time between the beginning and end of a workday is greater than 10 hours. The length of time includes any time off-duty, including

meals,rest periods or time between shifts. All employees who work a covered spread of hours in a single workday are entitled to one additional hour’s pay at minimum wage for that day.

REPORTING

We have a solution for you. Whether you need something that is simple or something that is customized we can help. Please speak with one of our team members to choose the right report for you. If there is a need for a particular report that has to be customized our “Report Writer” tool can assist. Please note: Some reports may require an additional fee for customization needs.

SUPPORT SERVICES

- GL Interface Background

- Screening Solutions

- POS Interface

- Labor Law Posters

- Employee Pay Cards

- Please Ask for More