Restaurant Payroll Services

Restaurant Payroll Services We Offer

We have been handling restaurant payroll in the NY area for over a decade. We help businesses create accurate reports, manage time & attendance, and give back-office support so you can focus on what you do best—running your establishment. These are just some of the benefits of using our payroll services for your restaurant. Our online payroll system is easy to access and saves you and your employees precious time.

Why Choose Premier Payroll Solutions?

Business owners choose Premier Payroll Solutions because we’re focused exclusively on servicing restaurants like yours. We know how important it is that employees get paid the right amount at the correct times. So we work hard to keep up with all the latest state and federal laws affecting restaurant operators. We make sure you stay compliant in everything from tip reporting to workers’ compensation.

For more information about the Restaurant Payroll Services offered, contact us or request a quote today.

PAYROLL ADMINISTRATION

Payroll taxes can be complicated, confusing, and compliance is constantly changing. PPS handles all the calculations of Federal, State, and local agencies. We make all the necessary payments on behalf of our clients. Should there be a mistake in a payment we pay the penalty and interest. It is like having insurance for your payroll tax obligations.

HUMAN RESOURCES SUPPORT

- Human Resources

- Library Phone support

- CMS – Online training (Sexual Harassment)

GENERAL LEDGER INTEGRATION

Premier offers all of its client the ability to create a GL file that can be uploaded directly into their accounting software such as Quickbooks or Restaurant 365.

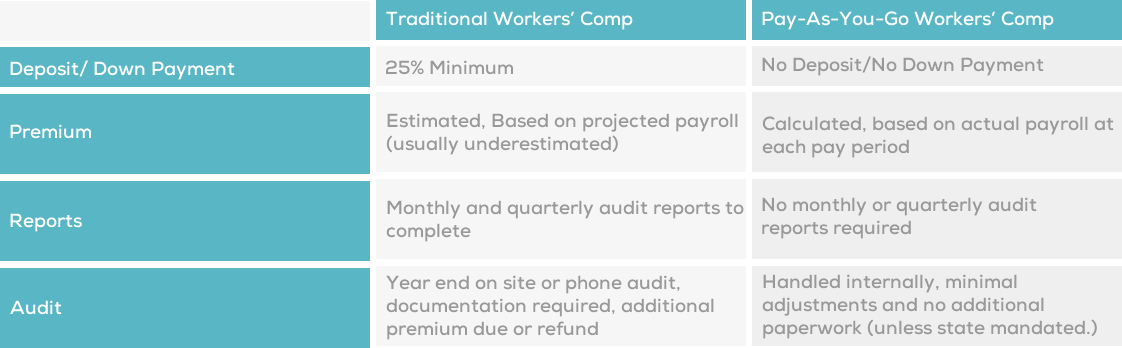

PAY AS YOU GO WORKERS’ COMPENSATION

PAYGO (pay-as-you-go )billing solution for your worker’s compensation coverage. This allows you to pay your workers compensation premiums as you run your payroll each pay period. This solution makes it easier than ever to manage cash flow. Premiums are automatically drawn from your designated checking account every time payroll is processed. Save time and money No down payment or deposit Premium is calculated on actual payroll at each pay period, not estimated Competitive rates with quotes from multiple insurance companies No checks to write, premium is automatically debited No monthly or quarterly audit reports to complete Audit adjustments are minimal–audit process handled internally with no additional paperwork, unless state mandated PPS doesn’t sell insurance. We work with your current to link it to your payroll

AFFORDABLE CARE ACT

ACA compliance can seem complex and confusing, but you don’t have to go it alone. Rely on PPS’s experts to help you understand what your organization needs to do to comply with the ACA’s employer requirements. Our specialists can help you navigate this kind of complexities and stay on top of regulatory changes.

In addition to the complex requirements, you need to analyze and access data from various systems — including benefits, payroll, and HR .

Get organized with:

Consolidated compliance reporting that helps determine employee classificationsMarketplace/Exchange notice management

Simplify Year End reporting but streamlining the process for all 1094-C and 1095-C printing and filings

MINIMUM WAGE

Hospitality Min wage can often be head-scratcher. PPS helps you figure out what the min wage for each employee and the state or jurisdiction they are in.

TIP CREDITS

If Min Wage wasn’t confusing enough, making sure you are paying your tipped employees right can be even more confusing. Premier keeps an extra set of eyes on your payroll every pay period to ensure you stay in compliance.

MEAL CREDITS

Unsure if you can charge for a meal? Don’t worry, PPS can help educate you on the right way.

TIME AND ATTENDANCE

Our Time & Attendance solutions will help improve the productivity, accuracy, and reliability of your payroll process. You as the customer have the ability to choose which method of collecting the data works best for you. Whether it is web-based, swiping employee cards, or biometric finger recognition we have the right solutions for your business.

SPREAD OF HOURS

Spread-of-Hours pay is due when the length of time between the beginning and end of a workday is greater than 10 hours. The length of time includes any time off-duty, including

meals,rest periods or time between shifts. All employees who work a covered spread of hours in a single workday are entitled to one additional hour’s pay at minimum wage for that day.

REPORTING

We have a solution for you. Whether you need something that is simple or something that is customized we can help. Please speak with one of our team members to choose the right report for you. If there is a need for a particular report that has to be customized our “Report Writer” tool can assist. Please note: Some reports may require an additional fee for customization needs.

SUPPORT SERVICES

- GL Interface

- Background Screening Solutions

- POS Interface

- Labor Law Posters

- Employee Pay Cards

- Please Ask for More